1040 Schedule C 2025 - FREE 9+ Sample Schedule C Forms in PDF MS Word, April 15, 2025, marks the deadline for filing your form 1040 and paying any taxes owed. What Is Schedule C of Form 1040?, Profit or loss from business as a stand alone tax form calculator to quickly calculate specific amounts.

FREE 9+ Sample Schedule C Forms in PDF MS Word, April 15, 2025, marks the deadline for filing your form 1040 and paying any taxes owed.

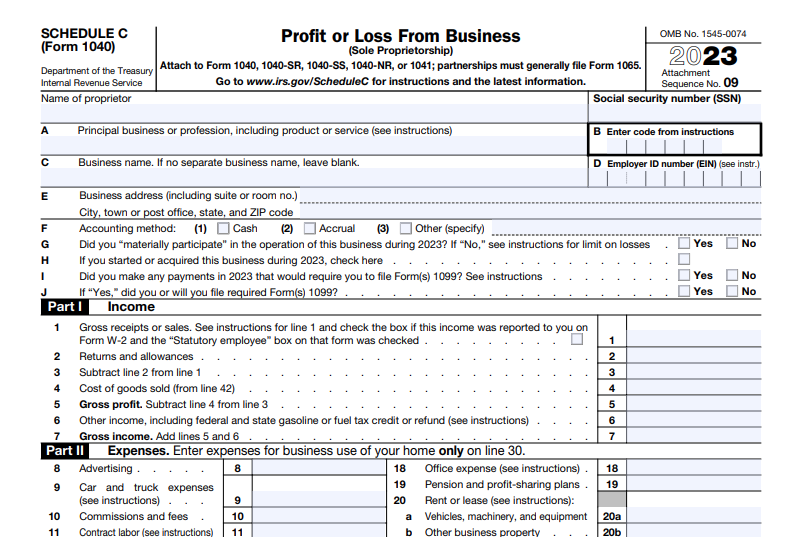

1040 Form 2025 Schedule C Season Schedule 2025, Learn who must file schedule c, what information it contains, and how to.

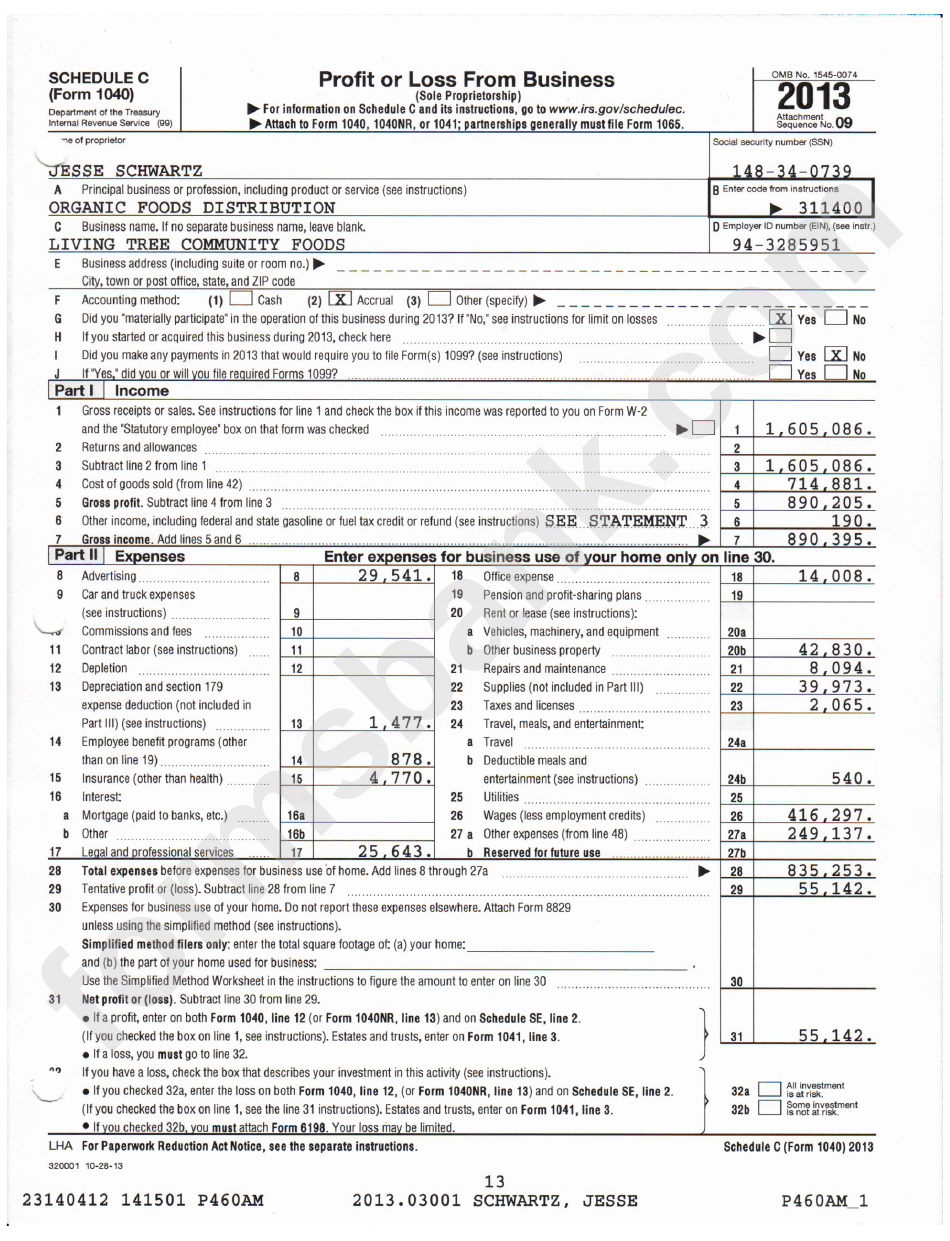

Fillable Schedule C Irs Form 1040 Printable Pdf Download, Learn who must file schedule c, what information it contains, and how to.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)

Schedule C (Form 1040) 2023 Instructions, April 15, 2025, marks the deadline for filing your form 1040 and paying any taxes owed.

1040 Schedule C 2025. Sole proprietors must use schedule c (form 1040) to report income or loss from a business they. An crucial aspect of your tax filing process involves knowing when your individual tax return is due.

What Is Schedule C for IRS Form 1040 Tax Guide, April 15, 2025, marks the deadline for filing your form 1040 and paying any taxes owed.

2025 Schedule 1 Form 1040 Ivonne Oralla, This question is specific to sole proprietor freelancers who (a) network with other freelancers, (b) sometimes outsource their work to other freelancers but never employ.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

Learn how to report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Learn who has to file it, what lines to include, and how to calculate your profit or loss.

Form 1040 Schedule C Sample Profit Or Loss From Business printable, Sole proprietors must use schedule c (form 1040) to report income or loss from a business they.

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax, Tax deadlines for sole proprietors in 2025 are as follows: